Unveiling the Dynamics of Real Estate: A Journey through Linear Regression Modeling

Introduction:-

Understanding the many factors affecting property prices is crucial in the ever-changing real estate world. From the location and size to the number of rooms, several variables contribute to a home’s value. In this article, we’ll explore linear regression modeling to uncover the patterns and dynamics behind real estate pricing.

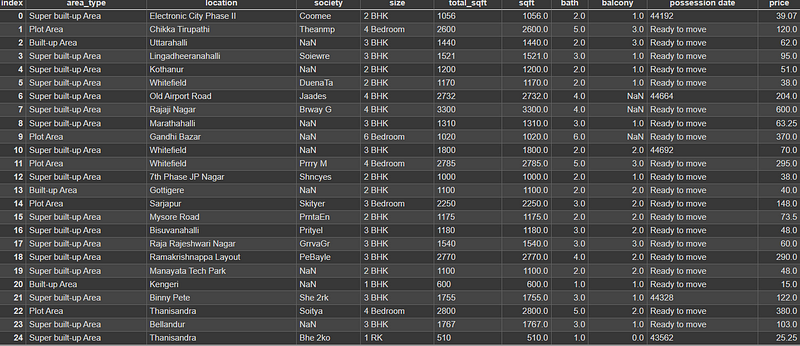

Exploring the Dataset:-

A vast dataset is our starting point. It has different properties. Each property has details like size, bathrooms, place, and kind. With over thousands of entries, the dataset is huge. It gives us lots of info to work with.

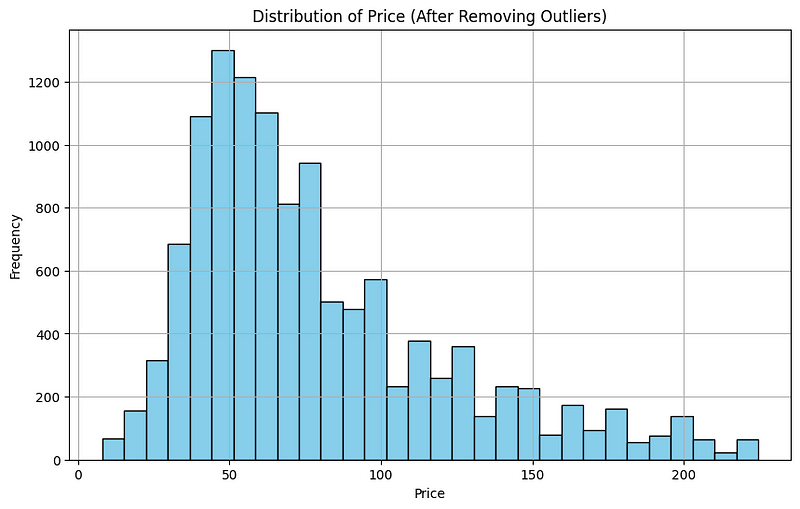

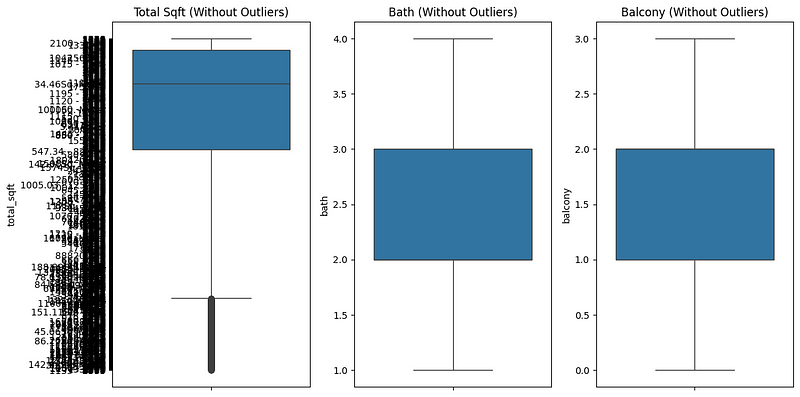

Preprocessing the Data:-

Before diving into modeling, we embark on a preprocessing journey to ensure the quality and integrity of our data. This involves handling missing values, removing outliers, and encoding categorical variables into numerical representations. By meticulously cleaning and preparing our data, we set the stage for robust and reliable analysis.

Feature Selection:-

With our data preprocessed, the next step is to identify the most influential features that drive property prices. Through careful examination and analysis, we narrow down our selection to a handful of key features, including total square footage, the number of bathrooms, and the location of the property. These features serve as the foundation of our regression model, capturing the essential elements that shape real estate prices.

Building the Regression Model:-

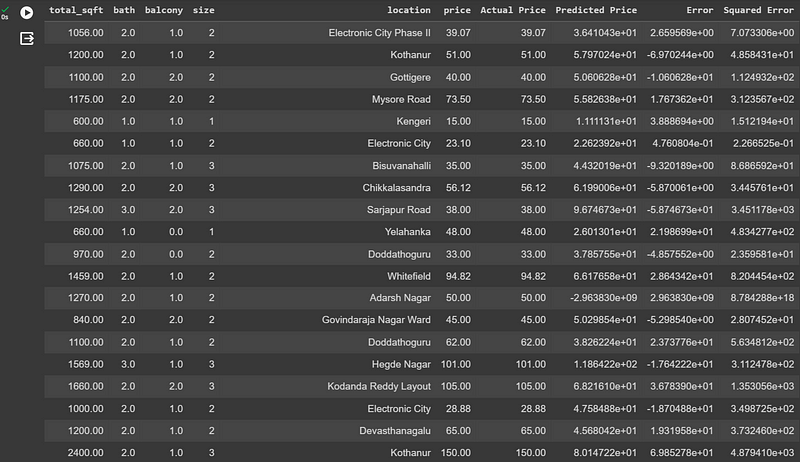

Using the selected features, we create a linear regression model to forecast property prices. By applying the mathematical principles of linear regression, we establish a predictive relationship between the chosen features and the target variable — property prices. Through training the model on our dataset and adjusting its parameters, we strive to develop an accurate and dependable real estate price predictor.

Interpreting the Results:-

We trained our regression model to analyze the coefficients linked to each feature. This helps us understand how each feature impacts property prices. The coefficient of a feature shows the change in the predicted price when that feature changes by one unit while keeping all other features constant. By carefully interpreting and analyzing these coefficients, we can unravel the intricate dynamics of real estate pricing.

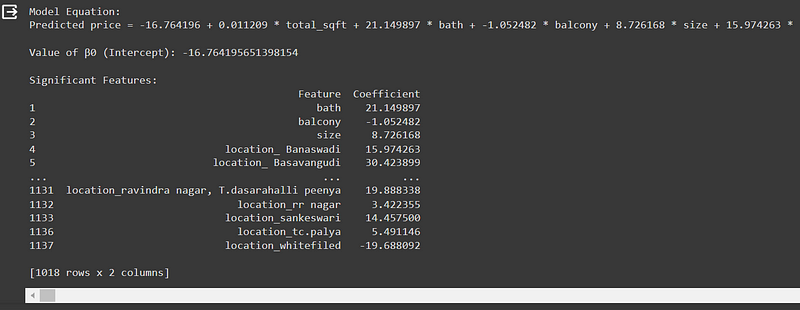

1. What is the value of β0 and how do you interpret it?

The value of β0 also known as the intercept term, is approximately -16.094309.

This value represents the predicted price of the property when all the other predictor variables (features) are set to zero.

In other words, it is the baseline price of the property. However, it’s important to note that in real-world scenarios, setting all features to zero may not always be meaningful or feasible, especially for features like ‘total_sqft’, ‘bath’, etc.

2. Which features are significant? Why?

Significant features are those whose coefficients have a notable impact on the predicted price of the property.

Based on the provided coefficients, features such as ‘bath’, ‘size’, and various ‘location’ dummy variables appear to be significant.

These features have coefficients with substantial magnitudes (e.g., absolute values greater than 1), indicating their significance in predicting the price of the property.

The significance of these features could be attributed to various factors such as the number of bathrooms (‘bath’) and bedrooms (‘size’), as well as the desirability or perceived value associated with specific locations.

Conclusion:-

Our analysis of linear regression modeling provides crucial insights into the complex world of real estate. By using data and mathematical modeling, we’ve uncovered the key factors influencing property prices. These findings empower real estate stakeholders to make informed decisions and confidently navigate the ever-evolving market.

If you’re interested in delving deeper into the real estate price prediction project, feel free to check out the GitHub Repository. There, you’ll find the complete code, datasets, and additional resources related to the project. You can also contribute to the project by providing feedback, suggesting improvements, or even adding new features. Happy coding!

If you have any suggestions for improving the project or spot any bugs, feel free to open an issue on the GitHub repository. Additionally, if you’d like to contribute directly to the project, you can fork the repository, make your changes, and submit a pull request. Your contributions are greatly appreciated and help make the project better for everyone!